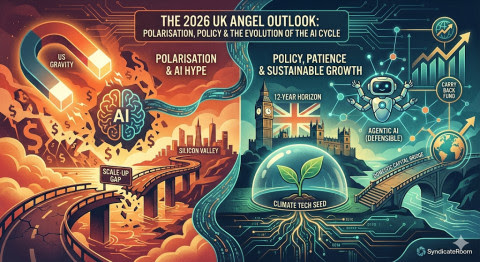

The 2026 angel investment landscape in the United Kingdom is entering what experts describe as a “two-speed market”, driven by contrasting investor behavior and global competitive pressures. While artificial intelligence continues to dominate early-stage attention, non-AI sectors are experiencing significantly higher hurdles when raising growth capital.

According to Tom Britton, co-founder of SyndicateRoom, 2026 represents a “sophisticated reset” as the ecosystem adapts to expanded EIS headroom, tactical follow-on funds, and an investor shift towards defensible innovation rather than hype cycles.

A Bifurcated Market

2025 marked a sharply polarised year for UK venture funding. Tier-one venture capital firms moved earlier into seed-stage AI opportunities, pushing valuations up and crowding out angels. Meanwhile, promising non-AI startups, especially at Series A and B stages, faced funding reluctance and longer due diligence processes.

One investor described the environment as “a polarisation between highly competitive and over-priced AI infrastructure rounds and a market unwilling to fund non-AI businesses.”

The result: a structurally uneven ecosystem with friction for non-AI founders and reduced accessibility for angels in the hottest AI categories.

The Economic Climate: A Competitive Drain

A major theme for 2026 is the UK’s ability to retain talent and companies as the U.S. accelerates structurally. Investors noted that U.S. fiscal incentives, higher salaries, and deeper capital pools are attracting British founders, while the UK’s regulatory burden makes domestic scaling more challenging.

Less than one-third of UK growth capital currently originates domestically, contributing to an emerging “scale-up gap” that risks exporting British innovation abroad.

To counter this, SyndicateRoom has launched the SR Carry Back EIS Fund I, leveraging a proprietary data engine to identify breakout scale-ups such as Kluster (B2B SaaS) and Anaphite (deep tech), with a mandate to help UK startups scale and stay local.

Deep Tech, Climate & Agentic AI Lead Sector Sentiment

Angel sentiment indicates 2026 allocations are favouring:

-

Deep tech

-

Agentic AI

-

Climate technology

Climate tech has notably moved from niche interest to strategic pillar. Investors now emphasise impact, defensibility, and founder sophistication in regulatory navigation—reflecting a departure from the late-stage AI hype cycle.

Defensibility & Tax Strategy in 2026

Investment strategy is shifting from chasing “the next big thing” to backing companies with:

-

Proprietary data

-

Regulatory readiness

-

Sustainable business models

Layered onto this is tactical tax planning. Vehicles like the Carry Back EIS Fund allow sophisticated investors to optimise risk while applying tax reliefs across multiple fiscal years.

Advice for New Angels: The 12-Year Perspective

Veteran angels advise newcomers to embrace:

-

Radical diversification (30+ startup bets)

-

Patience (12-year horizons)

-

EIS tax reliefs to offset inevitable failures

-

Avoiding premature exits on high-growth winners